As a real estate investor and developer, understanding and knowing how to navigate the

financing for building projects is a foundational piece of project success, business survival, and

growth. In 2025, we are in a challenging yet optimistic period. Rates are still relatively high, but

there is still so much opportunity for success if used correctly. Additionally, there is considerable

discussion that rates should be trending downward, which is creating cautious optimism for the

years to come.

What Are Construction Loans?

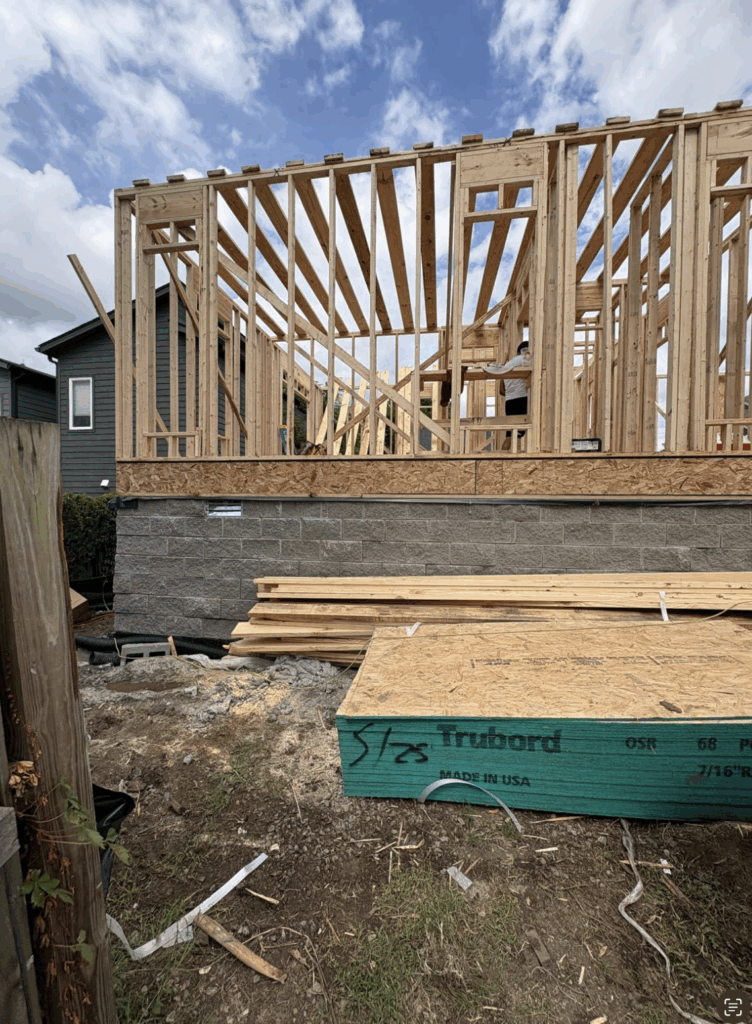

Construction loans are a type of loan product typically used by developers to finance the

construction of residential or commercial real estate projects. These funds differ significantly

from a typical 30-year fixed loan in several ways. For starters, the money is typically drawn out

in stages throughout the project’s duration, rather than being loaned out all at once. Additionally,

many times banks will require construction experience to be considered for these loans. Lastly,

these loans are considered higher risk than typical real estate loans. As a result, the interest

rates on these loans are significantly higher.

Current Construction Loan Rate Trends (2025)

As of mid-2025, construction loan rates remain elevated compared to pre-2020 levels, mainly

due to the Federal Reserve’s efforts to contain inflation through a sustained period of higher

benchmark interest rates. Here’s what we’re seeing in real terms:

● Typical construction loan rates: 7.25% – 12%

● Rate Origination: 1-2%

● Rate spreads over prime: Typically 1%–2%, depending on project size, location, and the

developer’s track record.

● Loan-to-cost (LTC) ratios: Generally capped at 70% – 90%

● Interest reserves: Commonly required, especially for larger commercial projects

Key Influencers of Loan Rates

1. Federal Monetary Policy

The Federal Reserve’s stance on interest rates remains the single most significant influence.

With inflation gradually declining but still above target, the Fed has adopted a cautious “hold and

watch” approach, maintaining relatively high short-term rates. This directly impacts construction

loan pricing.

2. Lender Risk Appetite

Many banks and lenders do not offer construction loans as a standalone loan product. They

believe them to be too risky and feel that they can do enough business without this product

offering. Typically, as markets become more volatile, this loan product would be the first to be

pulled back.

3. Material & Labor Volatility

Volatility in price can also be a significant factor. As it becomes harder to estimate costs, banks

may require bigger down payments or charge higher interest to developers to offset the

additional risk. They may also have stricter guidelines on who they lend to experience-wise.

They may choose to lend only to developers with whom they have been working for years,

rather than taking on new clients.

How Developers Can Mitigate High Rates

As rates increase, developers must devise strategies to remain competitive and profitable in the

face of additional building costs.

1. Lender relationships

Maintaining strong relationships with lenders is a wise decision in both good times and bad. As

they pull back their construction lending programs, they may continue to work with their

developers with whom they have a trusted relationship. It is essential to ensure that you do what

you say you are going to and demonstrate financial reliability to your lenders in all phases of the

market. You never know when you might need your lender to go above and beyond for you.

Real Estate, including lending, is a relationship-driven business.

2. Buying smarter and cheaper deals

As the cost of building increases in large part due to longer sales cycles and higher financing

costs, buying land at the former prices is no longer a winning strategy. The market from 2020 to

2023 was appreciating rapidly and effectively; any deal purchased was a winner. That is no

longer the case, and picking the right investment is a much more critical task. You have to say

no to a lot more deals and choose ones that have a larger upside to compensate for the

increased cost of operations.

Looking Ahead

The future is very bright and always will be with the right strategy. Understanding construction

loan rates in any market is a crucial component of success at all times. Rates are relatively high

right now and have increased rapidly; however, by maintaining a strong relationship with the

lender and carefully underwriting potential opportunities, it is a great way to stay competitive and

operate the business profitably. Additionally, the following years are expected to be trendily

favorable, which warrants some cautious optimism. In the meantime, buy right, know your costs,

and invest smart. Happy investing!

FAQs

1. How do current construction loan rates compare to the past decade?

We recently received a 5.99% rate from a bank in Nashville, TN, for a personal residence

construction loan scheduled for June 2025. The investment construction, however, will run you

about a point higher, at roughly 7% interest. It’s essential to note that interest is only paid on

drawn money. For example, borrow $700,000 and have only completed $100,000 in

construction. You will only pay on the $100,000 until more construction is completed.

2. What types of projects are getting better loan terms in 2025?

If you are getting a construction loan for a personal residence, you will get the best rates. If you

are strictly building a spec home for sale or investment properties, you will still get the best rates

out there by going through a local bank. The regional banks ‘ bank rates will be similar across

the board for all development projects.

3. What role does developer experience play in securing favorable rates?

Many banks will not even consider loaning to a developer that does not have at least two

projects under their belt. Others will still lend to first-time builders, but the rates could be as

much as 4% higher.

4. How are developers managing interest rate risk today?

Developers are managing interest rate risk by sharpening their pencils when it comes to

underwriting. The best way to mitigate risk is to buy a deal with more margin built in. A great

way to find high-margin deals is to collaborate with brokers to identify opportunities before they

hit the market.

5. Are private lenders and debt funds worth the higher rates?

Private lenders and debt funds can be a valuable resource for closing deals. They have less

underwriting on the front end and can get deals done very quickly. They focus on the deal rather

than the borrower’s financial statements. If the agreement is a good one with a high margin, it

should be able to absorb their additional financing costs with no issue.

6. What are common mistakes developers make with construction loans?

The biggest mistake that developers make with construction loans is being undercapitalized with

money for the deal. Not only are developers required to make down payments in the range of

10-15% of the total cost at close, but they are also required to fund the start of the project. Once

they start the project, the bank will reimburse them for those funds. Many investors forget that

they need those funds to push the project along and have reserves for making the monthly

interest payments

7. Are there any surprising incentives available in 2025?

In Tennessee, I don’t see any incentives like those on the retail side. If you can find a lender,

specifically a local bank (which is typically the most affordable option), then lending to you for

construction is a gift that should not be taken for granted.

8. How do labor/material cost fluctuations factor into loan terms today?

Finding a lender that is flexible with changing the scope of work would help tremendously with

labor and material costs. A contingency of 5-10% should be included for increased expenses

related to the scope of work for projects. This should address any fluctuations that occur during

the project.

9. What’s the outlook for construction loan rates heading into 2026?

There is no crystal ball for what the future holds for the economy and interest rates. Still, the

prevailing sentiment among active investors is that 2026 will be an excellent year for interest

rates. We will have to see what the Fed does in Q3 and Q4 of 2025.

10. What’s one thing you wish you knew about construction financing when starting?

I wish I kept better financial reports and tax returns from the very beginning. The bank will need

to underwrite you personally for construction funding, and the better picture you can provide to

them, the more they will be open to developing a relationship with you. The faster you can get

financing in your career, the more projects you can complete.